how are rsus taxed at ipo

How are RSUs taxed. The stock simply becomes yours when it vests.

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

What this means is that when you are paid in RSUs and you make less than 1 million.

. STCG taxed as per slab rates. ITR Form Due Date and Tax Audit Applicability for Unlisted Shares. When the Tax Cuts and Jobs Act was passed the IRS amended their rules to only require supplementary income like bonuses commission or stock compensation of up to 1 million to be withheld at Federal rates of 22 versus the previous 25.

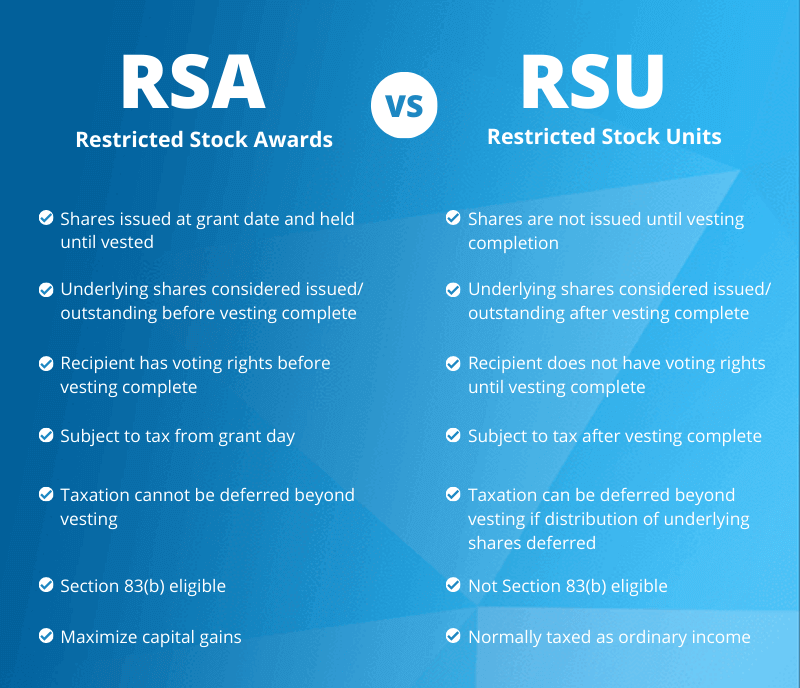

The special Section 83b election taxes employees before the RSUs vest. If employees keep the restricted stock units for more than a year the RSUs are taxed at a lower rate as capital gains. However the units are taxed in the year that employees receive them even if the stock unit declines in value.

Restricted stock units or RSUs are similar to stock options but you dont have to purchase them. In the case of a Non-Resident LTCG on Unlisted Stock is 10 without Indexation. The RSUs are taxed as extra compensation.

The stock simply becomes yours when it vests. Trader should file ITR 2 ITR for Capital Gains Income on Income Tax Website since income on the sale of unlisted stocks is a Capital Gains.

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

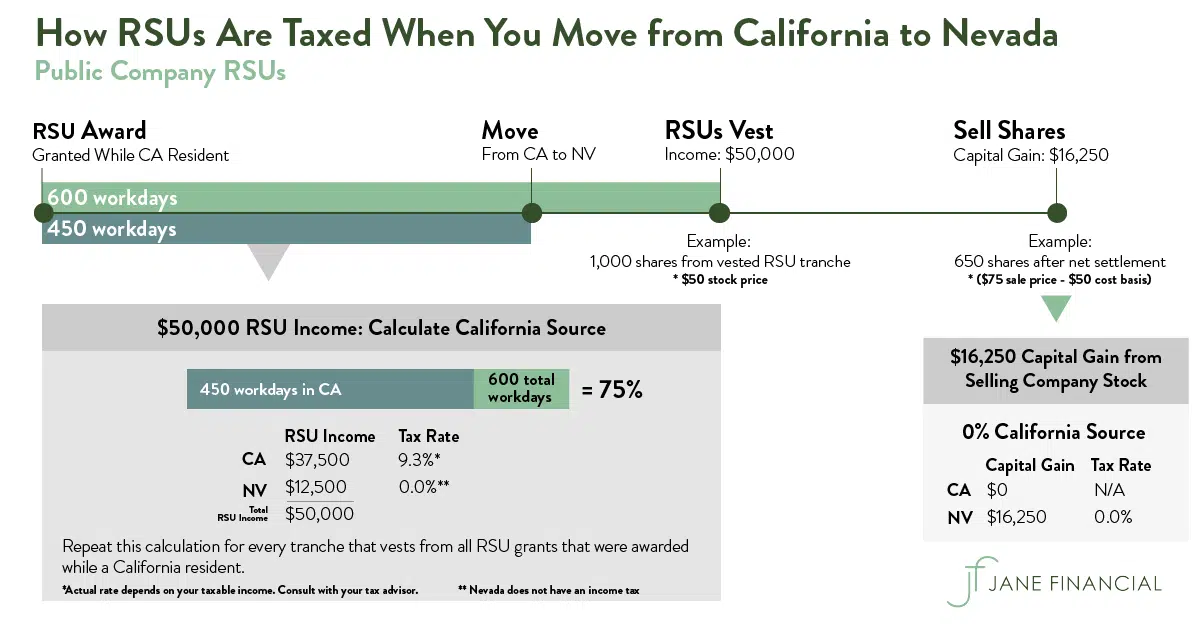

Restricted Stock Units Jane Financial

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Uber Lyft Pinterest And Zoom Sec Filings Reveal Trends In Private Company Stock Grant Design

Restricted Stock Units Jane Financial

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Restricted Stock Units Rsus Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

What Is A Restricted Stock Unit Rsu Everything You Should Know Carta

Avoiding The 1 Million Tax Trap New Section 162 M Regulations Affect Use Of Rsus By Ipo Companies Compensia